Ethereum Price Prediction February: Can ETH Reclaim $4,000 Amid Market Volatility?

Ethereum (ETH) has surged 300% from its 2022 cycle low of $880 but continues to lag behind Bitcoin. With Ethereum price today at $3,107, ETH faces strong resistance at $3,300 and $3,400. Crypto analyst Cas Abbé suggests ETH must reclaim $3,400 for a bullish reversal toward $4,000.

Read Ethereum Price Prediction February for more insights

Key Technical Levels

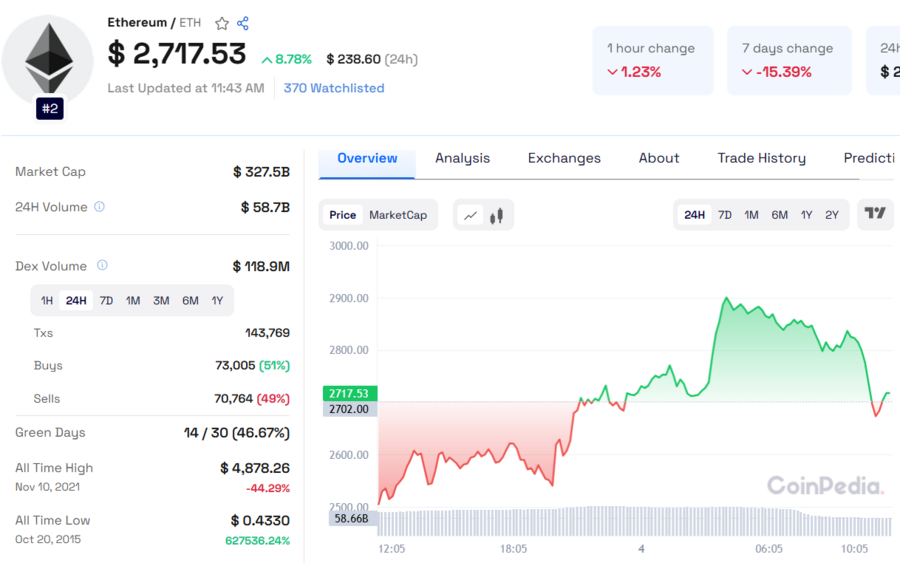

Ethereum’s 100-day moving average ($3,300) and a bullish flag’s upper boundary ($3,400) form a critical resistance zone. A breakout above $3,240 could trigger over $1 billion in short liquidations, per CoinGlass data. However, failure to hold $3,500 previously led to a pullback, raising concerns of a false breakout.

Market Liquidations & Whale Activity

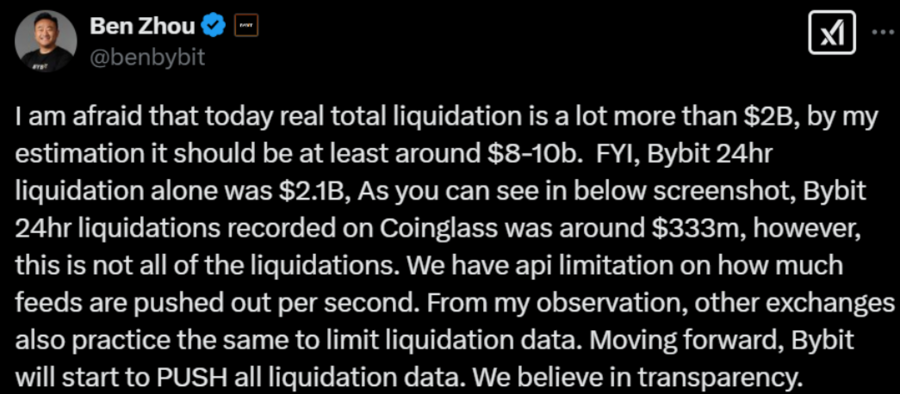

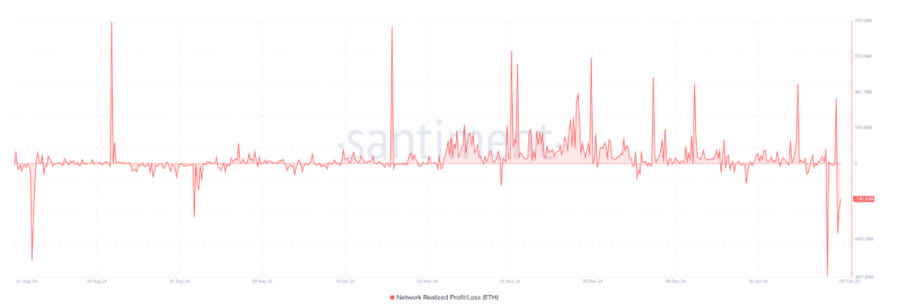

Ethereum suffered a major sell-off, dropping 25% before rebounding. Over $620 million in futures positions were liquidated, with Bybit CEO Ben Zhou noting actual liquidations were even higher. Spot market losses exceeded $1.2 billion over three days, the most since September 2023.

Despite bearish sentiment, whales are buying the dip. A wallet tagged "7 Siblings" acquired 50,429 ETH for $126 million after the crash, per Lookonchain.

Also Read: Bittensor Price Prediction 2025, 2026 – 2030: Will TAO Price Record A 2X Surge?

Ethereum Price Prediction & Future Outlook

The ETH/BTC ratio remains weak, with ETH’s dominance falling from 17.3% to 10.9% in 2024. Analysts suggest ETH may stagnate for 1-2 quarters unless real-world adoption improves. Ethereum price prediction for February depends on breaking $3,400; otherwise, a retest of $3,000 is likely.

Looking ahead, Ethereum price prediction 2025 hinges on institutional adoption and ETH ETF performance. For Ethereum price prediction 2030, sustained DeFi growth and network upgrades will be key drivers.